With Ramp, you can generate all the reports you need and view them in a single dashboard, making it easy to do your monthly financial reviews. You can combine Ramp’s real-time financial data with your accounting software or ERP data to help you make better business decisions. You can generate a recurring invoice report manually, but many business owners use accounts payable automation solutions to build theirs. This report shows which invoices recur from month to month, quarter to quarter, or over some other period.

Accrued Expenses vs. Accounts Payable: What’s the Difference?

After business travel, AP would then be responsible for settling funds distributed versus funds spent and processing travel reimbursement requests. While the business size ultimately determines the role accounts payable plays, AP fulfills at least three essential functions besides paying bills. When the invoice is paid, the accounts payable balance is decreased.

How Ramp became KIPP Nashville’s biggest financial win

Let us understand the differences between them through the comparison below to completely understand the concept of issuing an accounts payable credit or debit memo. Accounts receivable (AR) and accounts payable are essentially opposites. Accounts payable is the money a company owes its vendors, while accounts receivable is the money that is owed to the company, typically by customers. When one company transacts with another on credit, one will record an entry to accounts payable on their books while the other records an entry to accounts receivable. The accounts payable turnover refers to a ratio that measures how quickly your business makes payment to its suppliers.

Accounts payable aging report

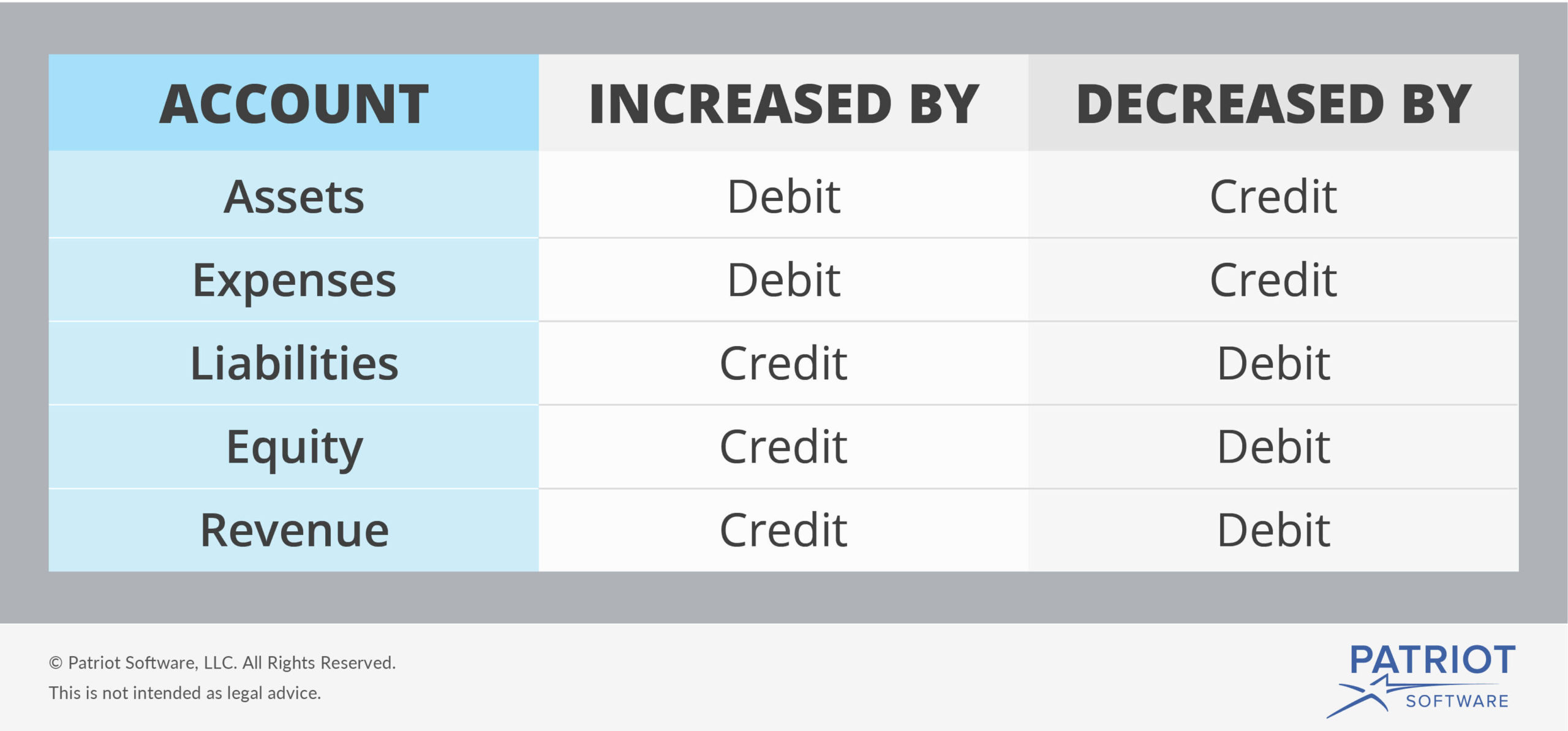

Meaning the accounts payable account gets credited as there is an increase in the current liability of your business. As accounts payable are deemed short-term obligations of your business towards its creditors or suppliers, these obligations will need to be met in less than a year. Therefore, accounts payable appears on the liability side of your balance sheet, under current liabilities. Debits and credits are fundamental concepts in accounting, used to record and manage all the financial transactions of a business.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding xero practice manager FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. QuickBooks can assist in accurately recording all expenditures, simplifying the process of filing for deductions come tax season.

To understand how debits and credits work, you first need to understand accounts. For payables for services, returning is not an option as services are perishable. The accounting entry for returns related to accounts payable is as follows.

Accounts payable (AP), or “payables,” refers to a company’s short-term obligations owed to its creditors or suppliers, which have not yet been paid. Payables appear on a company’s balance sheet as a current liability. When confirming accounts payable, your company’s auditors must take a sample of accounts payable. These majorly represent your business’s purchasing or borrowing activities.

The owner or someone else with financial responsibility, like the CFO), approves the PO. Purchase orders help a business control spending and keep management in the loop of outgoing cash. Accounts payable are found on a firm’s balance sheet, and since they represent funds owed to others they are booked as a current liability. Delaying the payments for a few days would help Walmart Inc to hold more cash to eventually pay to its suppliers. However, delaying payments for too a long of a period would critically impact Walmart’s relationship with its suppliers.

On the most basic level, debits indicate inflow, credits indicate outflow throughout all of your different accounts. When Robert Johnson Pvt Ltd makes payment to its supplier, the accounts payable account gets debited. This is because Robert Johnson’s current liability is reduced by $200,000. The offsetting credit entry for such a transaction is made to the cash account, because the cash worth $200,000 gets reduced.

Bills payable refer to the invoices you receive from your suppliers and vendors requesting payment. Bills payable amounts are entered in the AP category on the general ledger, so bills payable are a credit. Simply, bills payable represent liabilities, as they show purchases made on credit, so are credited to AP. In most instances, you won’t generate an audit report; your auditors will do that for you. But you can prepare for your audit by cleaning up operations and protocols. When auditors look at accounts payable, they’ll want to see that you’re following AP best practices.

- However, in some cases, it can also be debit when there is a decrease at the time the company settles those accounts payable or at the time the company discharged the liabilities.

- Below we’ll define accounts payable and how to set up an effective process for accounts payable management.

- The journal entry includes the date, accounts, dollar amounts, and the debit and credit entries.

Rather than being a liability account, accounts receivable is a current asset account. Accounts receivable works in much the opposite way of accounts payable, where you will often be debiting the accounts receivable account and crediting another. Once the customer pays off the invoice, you will credit your accounts receivable account to represent that paid invoice. Accounts Payable is presented as a current liability on a company’s balance sheet. It includes a collection of short-term credits extended by vendors and creditors for goods and services a business receives. Both accounts payable and receivable arise out of transactions of a business where they have either purchased or sold assets, products, or services on credit.